Eight Ways to Identify Fraud in Rental Housing

Eight Ways to Identify Fraud in Rental Housing

A record 20.5 million jobs were lost in April 2020, and the unemployment rate soared to 14.7% due to the coronavirus. What does this mean for the residential rental industry? It means that fraud is increasing, and tenant screening is getting harder every day.

Where to look for Fraud in Financial Documents:

Documents with Text Alteration have been edited either by adding new information, typically numbers, names, or addresses, or removing information such as expenses, liens, etc. This type of fraud is easy to produce with home office equipment and easily overlooked in the screening process.

1) Does the name on the document match the applicant’s ID?

It’s easier to alter a financial document than it is a government-issued ID. Check for discrepancies as the document may be stolen.

2) Is the income statement accurate?

Inflation or deflation of income is also common practice these days. Adjusted incomes can fraudulently grant the applicant approval to a unit they wouldn’t qualify for otherwise.

3) Is the income source correct?

Check out the listed business entity. Is the source a legal and real business entity? Do they have a phone number you can call or a location you could visit? An altered source of income can be a sign of criminal activity or be an entity created by the applicant to falsify income.

4) Is the document real?

Template Farms produce and distribute fake documents, such as references, background checks, criminal records. This type of fraud is increasingly popular because of its accessibility.

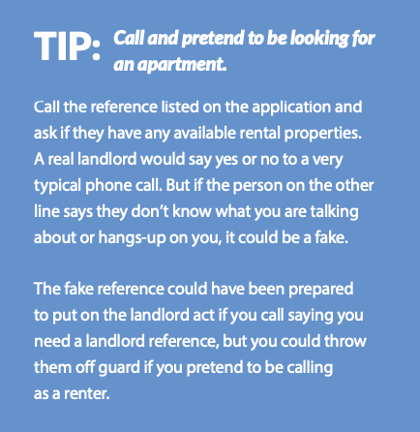

5) Are the references listed legitimate?

References can be faked by friends, family, and hired companies. If your applicant rented from an apartment or property management company, Google the company or call them directly. If your applicant has a private landlord as their rental reference, it’s harder to verify. Typically, you can tell if a reference is fake by looking up whether the given name on the application matches the property ownership or business registration.

6) Is your applicant who they claim to be?

Millions of people have fallen victim to identity theft, and the number is growing each day. If you can’t meet your applicant in person, schedule a video chat to review the application. Does the person on the chat match the ID? Do they answer questions they should know with ease?

7) Is your applicant a real person?

Synthetic fraud is a fake identity created from multiple sources, so check for inconsistencies. If multiple things don’t match up, it’s an indicator that the applicant is using a synthetic identity.

8) Perform your own background and credit checks.

Be sure to do your own criminal and credit checks with reputable providers and cross-check the rental application. They can be the one source that the applicant cannot digitally modify before you receive the data.

Although it can happen to anyone, keep in mind that most prospects are not trying to scam you. It’s important to be aware of many things when processing an application.

This article was contributed by Joelis Barandica- Rodriguez, Regional Director of Education with CONAM Management Corporation, as a part of the XCEL Committee's goal to provide regular, educational, posts for TAA's blog.